R&D tax credits are a generous government incentive to reward UK companies for investing in innovation. You can claim up to 27% of your R&D costs. The scheme is managed by HMRC and claimed as part of your company tax return submission.

Myriad is your trusted R&D tax credit partner. We have helped businesses make successful claims for over 23 years. Partnering with Myriad means your claim is robust, compliant and optimised.

Understanding R&D tax credits can be complicated for businesses - but not anymore! We've crafted an easy-to-follow guide with informative sections to help you determine if your company could benefit from a claim.

R&D tax credits are a popular government incentive that empowers you to reduce your Corporation Tax bill for innovative projects.

Since 2000, the UK government has offered a cash injection to SMEs and large companies to promote innovation in the UK. This credit can be worth up to 27% of the expenditure invested in R&D.

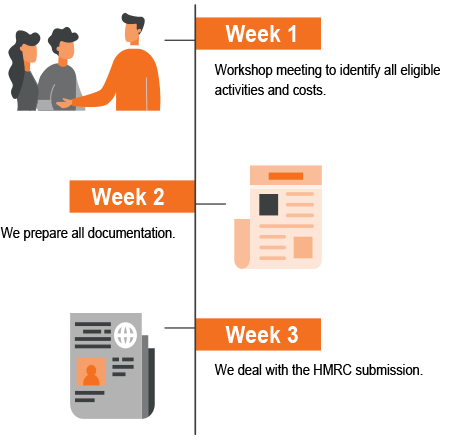

Claiming your entitlement requires some know-how; an R&D technical report and detailed report on costs claimed are essential to make a valid claim.

There are two main criteria for a project to be eligible for R&D tax relief.

Your project must:

On top of this, your project must not be in social sciences, arts, humanities or economics.

You can seek to make an advance by developing a new product, service or process, or by improving an existing one.

For example, a company with a project in IT which involves developing a new process for extracting a specific form of data, which the company’s software experts cannot easily say how to create, may qualify.

However, a company developing a new e-commerce site would not qualify, as this does not advance any technology, and a software expert could say how to achieve it quickly.

To prepare your claim, you’ll need:

Before you claim, you must submit an Additional Information Form (AIF), which requires information from the technical and costing reports. You’ll also need to check whether you need to notify HMRC in advance.

You’ll submit your R&D tax claim using your Company Tax Return.

"Myriad played a pivotal role in navigating the complexities of our R&D Tax Credit submission process. Priya's expertise in R&D costings and meticulous attention to detail was instrumental in guiding us through each step. Her collaborative problem-solving approach and clear and responsive communication ensured smooth project completion within a tight deadline. Working with Priya and Myriad was a straightforward and productive experience, and I would confidently recommend their services as a reliable partner."

Adrian Tan

RedCloud Technologies

"Priya is great to work with. She is approachable, bubbly and very collaborative, which helps ease into building a professional relationship quickly. She has worked on our R&D tax claim before, and her dedication and attention to detail are commendable. She is hands-on and has always followed up with the team and myself to ensure each step of the claim goes as smoothly as possible from beginning to end."

Keshma Sahye

Vison RT

"Jillian's approach to our R&D tax credit application was characterised by meticulous attention to detail, a deep commitment to understanding our technology, and an ability to present our vision in a compelling and accessible manner. Her optimism and resilience, especially in moments of challenge, were supportive and truly inspiring. All of this resulted in us successfully securing R&D tax credits, and we look forward to working with Jillian and Myriad again in future."

Waqas Akram

RedCloud Technologies

"CACI partnered with Priya and Myriad to complete our R&D Expenditure Credit claim for the last two financial years. Priya quickly understood our business and combined that with her deep knowledge of the tax incentive scheme to optimise the value of our claim. This resulted in a total claim substantially more than our forecast. Priya could work flexibly around our corporate policies, such that the calculation was finalised swiftly and collaboratively, with the resulting claim being folded into our existing tax filing processes - as required by our internal controls."

Sam Pickard

CACI

"Jillian worked collaboratively with the management and development team at Lumi to execute the annual Research & Development tax review for the software development projects undertaken. With a keen understanding of software development's intricate tax landscape, Jillian guided the team through the process, delving deep into the nuances of Lumi's software estate and the development undertaken to enhance this. The synergy between Myriad and Lumi was evident in the seamless flow of information and collaboration. Jillian fostered an environment of open communication and joined multiple deep-dive sessions, probing for evidence to ensure the submitted position was accurate and compliant. Myriad's comprehensive tax report showcased the team's commitment to excellence."

Marc Harper

Lumi Holdings Ltd

"FlowForma Limited has worked with Myriad since 2022 on our annual R&D Tax Credits claim. The scope of this claim is the software research and development initiatives that FlowForma have undertaken during the claim period. FlowForma initially selected Myriad as our partner as they offered a complete service to help us prepare the required reports and submit our claims. Working with Myriad, the claims submitted to date have been accepted, allowing the company to invest further in our Research and Development initiatives. Jillian has a good understanding of the technology stack we use. Jillian's approach to preparing our annual R&D Tax Credits report has made this process easier, and Jillian has constantly added value through her probing questions and valuable feedback."

Gerard Newman

FlowForma Ltd

"We had a great experience working with Myriad on an R&D tax credit claim for our temporal metadata graph visualisation product. Millie’s deep technical knowledge made it incredibly easy to discuss the project despite its complexity, and her writing brought out the best parts of our work."

Ronan Kumar

Solidatus

"CACI partnered with Millie and Myriad to complete our R&D Expenditure Credit claim for the last two financial years. This involved qualifying many projects across our business and dealing with numerous stakeholders. During this time, Millie demonstrated vast amounts of patience and organisation. For the required detailed technical writeups, Millie conducted a thorough but easy-going meeting with the relevant project leads, then used the information gathered to draft an elegantly written report which hit all of HMRC's requirements for claim eligibility. This was all completed within our tight deadlines".

Sam Pickard

CACI

"Working with Rabia on our recent project was an exceptional experience. As a Corporate Tax Associate, Rabia was pivotal in guiding us through the complexities of our tax obligations, particularly in R&D tax credits, which were crucial to our project's success. The results of Rabia’s work were outstanding. Thanks to her diligent efforts, we maximised our tax benefits, which significantly impacted our project. Rabia’s professionalism, combined with her friendly and approachable demeanour, made the entire process not only fruitful but also enjoyable. I highly recommend her services to any business seeking expert tax advice."

Aria Pour

Bynaric

"With great pleasure, I offer my highest recommendation for Rabia based on her invaluable contributions to our R&D projects. Rabia consistently demonstrated exceptional skills, dedication, and a remarkable ability to drive results throughout our collaboration. Rabia is not only exceptionally skilled in her field but also exhibits a remarkable level of promptness and helpfulness. Her responsiveness and willingness to go above and beyond have greatly enhanced the efficiency and effectiveness of our projects."

Sajanth Sritharan

WIS Accountancy

"Had a wonderful experience claiming R&D Tax Credits, a subject for specialists, and they are incredibly knowledgeable. Barrie and the team were fantastic at dealing with the claim on behalf of my client. They have a brilliant system to assist small businesses that have invested in R&D and need that additional boost, without phenomenal costs. Recommended for anyone dealing with R&D Tax Credits!"

Ivan Soares

TaxInc Associates

"We've been working with Barrie and his team for 4 years for R&D tax credits and they have done a great job in understanding our business and the development infrastructure."

Rahul Shah

Lumi Holdings

"I was really impressed by Barrie’s input throughout the R&D tax credit application and was blown away by the 24/7 response rate to complex questions."

Brett Harding

YourTour Ventures

To be eligible for R&D tax credits, you must:

With the above list and at least one qualifying project, you’re nearly there.

For first-time claimants or for companies whose last claim was more than 3 years ago, you’ll need to let HMRC know that you intend to make a claim.

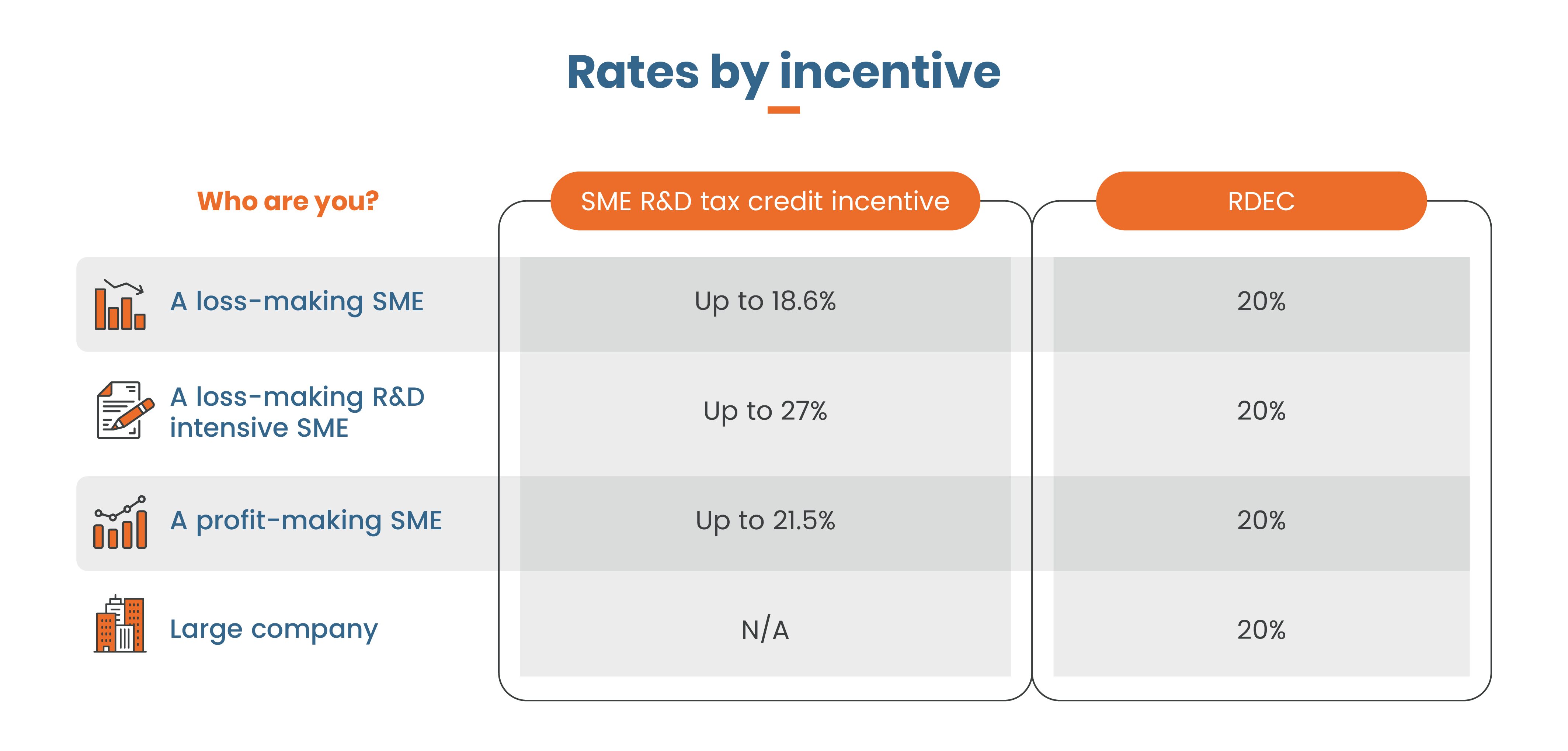

Understanding which R&D tax scheme you can apply through can be tricky. There are two schemes to consider: the SME scheme and the R&D Expenditure Credit (RDEC).

As you might guess from its name, the SME scheme is aimed at SMEs or Small or Medium-sized Enterprises.

The RDEC scheme is aimed at large companies and SMEs who cannot claim the SME scheme due to subsidisation rules.

Find out which scheme you're eligible forTo be classed as an SME for research and development (R&D) tax credit purposes you must have fewer than 500 staff, and either: A turnover of no more than €100 million; or Gross assets of no more than €86 million.

This R&D tax credits calculator will provide you with an estimate of the corporation tax savings that you may receive from HMRC following a claim for R&D tax relief.

In this eBook, we help UK businesses understand everything they need to know about the R&D Tax Credits scheme.

You can learn about the latest changes, how to maximise your claim and more. So whether you’re a small or medium-sized business or a large company, there’s something for everyone in our latest guide.

Myriad is your trusted and experienced R&D tax credit partner. Our professional and friendly team of expert tax advisors, qualified accountants, and industry-experienced technical specialists have helped innovative UK businesses make successful R&D tax claims for over 23 years. Partnering with Myriad means your claim is robust, compliant and optimised.

With a thorough analysis of every project, our professionals will analyse your project from a scientific & technological perspective to ensure it qualifies under the scheme's ever-changing guidelines before proceeding any further.

Get in touch today!

Tax Cloud is an online portal that offers UK businesses the ability to prepare their own R&D tax credit claim like an R&D claim expert. We make understanding and preparing your claim simple, fast and cost-effective.

Our portal is designed to help you get the most out of your claim, quickly and easily. Plus, our fees are much lower than those of traditional consultancies. Sign up today and see the difference for yourself!

Enquiries into R&D tax relief claims by HMRC are on the rise.

We are well equipped to offer actionable advice on any R&D tax relief enquiries made by HMRC and provide proactive reviews that can help ensure complete peace of mind during these uncertain times.

A business can submit an R&D tax relief claim at any time up to the first anniversary of the filing due date of the company tax return for the accounting period in which the claim is made (paragraph 83E(1) of Schedule 19 to the Finance Act 1998). This means a business can claim for R&D tax relief going back two accounting years. The claim can be made in a company tax return or an amendment.

Many businesses don’t realise that they are undertaking eligible qualifying activities. It is not uncommon for their accountants to forget to tell them about R&D Tax Credits or even to say to them that they don’t qualify.

If your technical lead (the R&D manager, lead engineer, or lead developer) is struggling to overcome the technical challenges of your project – if they are scratching their head wondering how to proceed or losing sleep worrying about the technical uncertainties they face – your project will almost certainly qualify for R&D Tax Credits.

It’s well worth discussing this with our team before you decide.

HMRC will follow their Statement of Practice SP 05/01 guidance to deal with late claims. The success of these appeals depends on the facts of the case;

When you claim R&D tax relief, one of the HMRC's R&D specialist units will review and process it. It is standard practice for an inspector at the HMRC R&D unit to review the first claim that is made by a business. The inspector will risk

Under the SME scheme, R&D expenditure cannot have been incurred by undertaking R&D as a subcontractor.

If a ‘large company’ subcontracts its R&D to an SME, the SME can make a tax credit claim, but only using the larger company scheme (RDEC).

Where successful, this will entitle the company to a 25% deduction for eligible R&D expenditure. Where the SME claims under the Large Company Scheme, losses arising from that expenditure cannot be surrendered for a payable tax credit.

Where a company has received a grant to fund an R&D project, it can only receive R&D Tax Credits using RDEC. State aid prevents the company from using the SME scheme regardless of size. If your company has received a relatively small grant, it could lose money overall. So it’s always worth working out the best option for your company.

(See also: R&D Grants)

You will need to complete a Full Company Tax Return (CT600) and not a Short Company Tax Return.

If you are an SME, you will need to use CT600 (2023) Version 3 and complete the following boxes:-

Common examples of software development projects that may qualify for R&D tax relief include:

Common examples of product and process development projects that may qualify for R&D tax relief include:

HMRC works to process applications for R&D Tax Credits within 40 working days. However, the processing time required for HMRC to review and consider an R&D Tax Credit claim depends mainly on the nature of the claim and the complexity of a company’s structure and accounting. Even the time of year can make a difference, with peak accounting times such as March and December being particularly busy, resulting in slower processing times.

You can claim relief on costs that have been expensed through the Profit & Loss account. In certain circumstances, you can also claim capitalised expenditure (providing that the assets purchased have been classified as Intangible Assets).

The main areas of costs that can be claimed are:

It is not uncommon for an R&D team to consist of many individuals from different parts of the business.

Your R&D project team may include the R&D Manager, a Lead Developer, Engineers, Project Co-ordinators, CAD Engineers, Quality Control and Testing specialists, and Cost Accountants, as well as members of the senior management team.

R&D Tax Credits for profit-making SMEs

The R&D tax relief would enable a profitable SME to reduce the corporation tax they pay on profits for the period by the amount of the enhanced deduction.

The current R&D tax credit rate results in a 21.5% benefit on R&D expenditure for profit-making SMEs. If the deduction is greater than the SME’s profit for the period, then this will create a loss for corporation tax purposes.

R&D Tax Credits for loss-making SMEs

Where the additional enhanced R&D deduction is greater than the SME’s taxable profit for the relevant accounting period, this creates a loss for corporation tax purposes.

The SME can then decide between the following options:

The company can surrender the lower of the enhanced R&D relief or the taxable losses for the period.

The losses are surrendered for a cash credit (tax credit payable), and the current rate is 10% (14.5% for R&D-intensive companies). So, as the enhanced R&D tax relief is 86%, a cash credit can be worth as much as 18.6p for each £1 of eligible R&D expenditure.

The Research and Development Expenditure Credit was introduced on 1 April 2013 and replaced the original Large Company scheme entirely on 1 April 2016.

The critical difference between the RDEC and the Large Company scheme is that the RDEC allows a loss-making company to receive a payable tax credit.

The RDEC is a taxable receipt, and it is paid net of tax to companies with no corporation tax liability. From 1 April 2023, the RDEC rate was increased from 13% to 20%. From 1 April 2023, the corporation tax rate has risen to 25% from 19% for companies making a profit of over £250,000. The benefit would, therefore, be 15% of the eligible R&D expenditure.

There are a couple of ways to account for R&D tax credits, which depend on whether the claim is made under the SME scheme or the RDEC scheme.

The SME R&D Tax credit is not part of the company’s taxable income. Therefore, it will be shown as an adjustment to the company’s corporation tax charge in the income statement (i.e., a “below the line” adjustment).

This can be done before finalising the statutory accounts for the year the claim is made or retrospectively by way of an over/under provision to the corporation tax charge.

The Research and Development Expenditure Credit (RDEC) works slightly differently because the adjustment occurs “above the line” in the income statement. The RDEC forms part of the company’s income for corporation tax purposes. There are a few ways to account for this; therefore, the most appropriate method is best discussed with your accountant/auditor or R&D tax advisor.

Yes, we can. At Myriad, we tailor our service and are led by our clients, who adapt our approach to suit their needs.

By working collaboratively with other advisors, the process becomes smoother and more efficient.

HMRC has increased the number inspectors in its R&D team and therefore enquires are becoming more common.

Myriad’s team of expert advisors will support you every step of the way. This is part of our full consultancy service, and there are no hidden charges.

To be classified as an SME, you must have fewer than 500 employees and either a turnover of no more than €100m or gross assets of no more than €86m.

If you breach the turnover and balance sheet thresholds but have less than 500 employees, you will also be classified as a large company for R&D tax purposes.

Other groups and connected enterprises must also be considered when assessing whether your company meets this criterion.

Acquisitions, takeovers and mergers can also impact a company’s SME status.

This can be complicated; therefore, always speak to a specialist advisor to ensure your claim is made under the correct scheme.

R&D tax credits are a form of Corporation Tax relief. So, as a Limited Liability Partnership (LLP), you cannot usually claim as you are not registered for UK corporation tax.

However, if your LLP has a corporate member and they are subject to corporation tax on their share of profits from the LLP, then they may be able to benefit from R&D tax relief on R&D activity carried out by the LLP.

HMRC will offset any payable SME R&D tax credit and RDEC against outstanding liabilities for Corporation Tax, VAT, PAYE and NIC before repaying you.

This will happen unless the tax liability has been formally deferred.

Claims for R&D Tax relief are made via the Company Tax Return (CT600).

Before submitting the CT600, you must submit an R&D Additional Information Form detailing the R&D project and costs.

Additionally, for accounting periods beginning on or after 1 April 2023, you must complete the R&D claim notification form in some circumstances.

HMRC would expect someone described as a competent professional to be knowledgeable about the relevant scientific and technological principles involved, aware of the current state of knowledge, have accumulated experience and be recognised as having a successful track record.

This person is likely to be a lead developer or engineer. This person will be best placed to assess which of your projects will count as R&D and to provide the relevant details to enable technical reports to be written.

Choosing the right advisor is an important decision, and a good working relationship with your advisor will ensure your claims are delivered efficiently, are robust and defensible, and are maximised in value.

If you are looking to change advisors, first check your contract; there may be clauses that tie you in for multiple years and carry fees if you terminate. If your current contract doesn't contain such a clause or has expired, then switching is easy; tell your old advisor that you no longer wish to use their services and select a new advisor. At Myriad, we make this transition easy exchanging the relevant information promptly to ensure a smooth handover.

Yes, assuming qualifying activities are being undertaken. Payments to subcontractors can be included.

You can claim up to 65% of the qualifying costs if the third party is not connected to your company.

The work you have subcontracted out need not be classified as R&D in its own right but should form part of a larger project considered to be R&D.

Currently, there is no requirement for the subcontractors to be UK residents or carry out the work in the UK; however, for accounting periods starting on or after 1st April 2024, this will change.

The government intends to limit relief for subcontracted activities to those that take place in the UK only. This will apply to Externally Provided Workers (agency workers) as well. There will be some very narrow exceptions to this, so please speak to an advisor as soon as possible to find out how these rule changes will affect your claim.

For claims made under the RDEC scheme, subcontractors must be individuals or qualifying bodies to be eligible, i.e. not Limited Companies.

R&D starts when work to resolve the scientific or technological uncertainties starts and ends when these uncertainties are resolved or work to resolve them ceases (the “R&D Project Period”).

The R&D Project Period may start or end during an accounting period, so staff time on each R&D project will need to be apportioned accordingly.

Our experts will help you determine the R&D boundaries of your project, identify the elements of R&D within commercial projects and advise you on how to present these to HMRC.

Calculating an accurate apportionment of staff time spent working on qualifying activities within the R&D project will depend on the nature of the work done and the records that you have in place.

Staff joining or leaving the company during the year must consider whether staff are working full or part-time hours.

Staff job roles will also need to be separated into those roles that directly contribute to activities and indirectly support activities.

We advise keeping and maintaining contemporaneous time-keeping systems; however, a formal timesheet system is not always necessary.

If there is no time for recording records in place, staff time will need to be allocated on a just and reasonable basis.

Record-keeping is an essential part of claiming R&D tax relief, and although HMRC sets no specific requirement, they expect to see some form of record.

HMRC accept that first-time claimants or claimants in their first three years are unlikely to have detailed records in place to support all of their R&D. Meeting notes, planning materials, and workflow tracking are all excellent examples of what documents can be kept to support your claims.

Our advisors can work with you to create bespoke methodologies and appropriate record-keeping for your business.

Yes, Companies will need to inform HMRC in advance that they plan to make a claim. They will need to do this using a digital service within six months of the end of the period to which the claim relates.

Speak to an advisor as soon as possible to determine whether you are eligible and ensure your pre-notification is made within the timeframe.

Step 1 of #

Is your business registered for Corporation Tax in the UK or are you a partnership with corporate owners?

Have you developed new or improved existing products, processes or services in the last 2 accounting periods?

Does your business have fewer than 500 staff, and either: A turnover of no more than €100 million; or Gross assets of no more than €86 million?

Sorry, you must be a UK limited company or be a Partnership with corporate owners to be eligible for R&D tax credits.

In order to qualify for R&D tax credits you must be seeking to advance science or technology within your industry. As you’ve not developed any new or improved any existing innovative tools, products or services, and not re-developed any existing products, processes or services in the last 2 years. It is unlikely you have any qualifying activity. If you’re unsure, email or call us and we’ll help clarify.

In order to claim R&D tax credits, you need to either employ staff or spend money on contractors, consumable items and other items. If you’re unsure, email or call us and we’ll help clarify.

Thanks for that!

Congrats!! Based on your previous answers, you will qualify for the SME scheme. If you’d like some help maximising and securing your claim, please email or call us.

Congrats!! Based on your previous answers, you will qualify for the RDEC scheme. If you’d like some help maximising and securing your claim, please email or call us.

Speak to an expert Back