Video Games Tax Relief (VGTR) is a government funding incentive that allows digital gaming businesses to claim up to 20% of their core production expenditure.

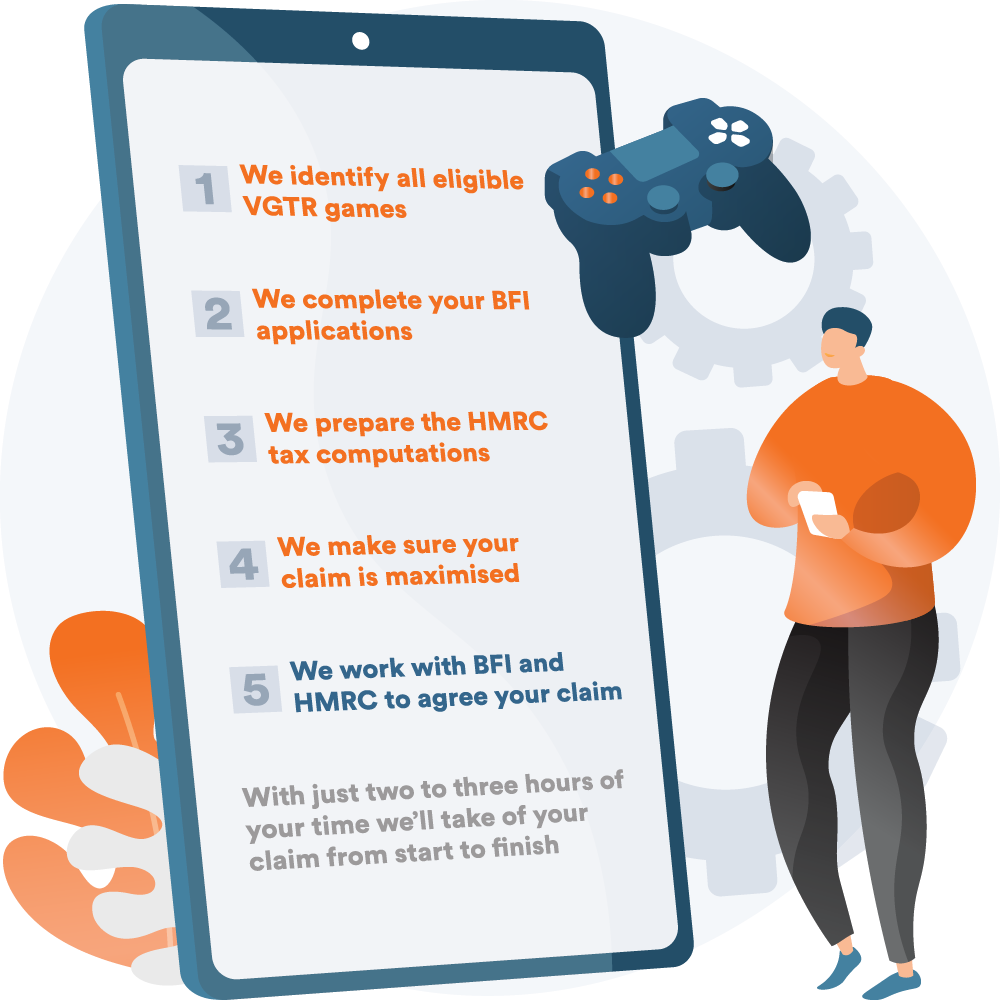

Myriad has been helping UK game developers navigate the VGTR claim process for over a decade. As your VGTR partner, our specialist tax advisers and BFI consultants will ensure your claim is accurate, compliant, and optimised.

Are you in the video games industry? Let us help you understand how Video Games Tax Relief (VGTR) can help your business. From eligibility criteria to potential savings, we cover six essential sections on VGTR and provide all the information necessary to make informed decisions about this potentially lucrative tax relief option.

Video Games Tax Relief (VGTR), also known as the UK Games Tax Relief Scheme, is a tax relief incentive designed to support UK-based game developers.

VGTR allows qualifying companies to claim a payable cash tax credit on eligible expenditure. Games produced for advertising or promotional purposes, as well as gambling, are excluded.

Video Games Tax Relief is worth up to 20% of the core production costs of a game. Game developers can claim VGTR on whichever is lower:

If the game is profitable, the Video Game Tax Relief can be used to reduce a Corporation Tax bill. If the video game makes a loss, claimants can receive a cash payment from HMRC at a rate of 25%.

So, whether you're looking for tax reductions or direct financial contributions from HMRC - there's much opportunity available through this generous programme!

To qualify for VGTR, you need to meet the following criteria:

If you meet the above VGTR criteria, and your video game can be played on any one of the following devices, you could be entitled to Video Games Tax Relief:

"DR Studios, part of the 505 Group, has worked closely with Myriad since 2018, particularly with Chris Dowsett, who has managed several BFI (British Film Institute) certification applications and subsequent video game tax relief (VGTR) claims for us. Chris is an excellent 'details' man. He's managed both our BFI certification applications and subsequent tax relief claims from start to submission, and we couldn't be happier with the relationship. Chris is backed by the specialist tax team at Myriad, which has years of experience in the creative industry tax relief field. I recommend Chris and Myriad if you're considering a VGTR claim."

Andrew Stephens

DR Studios - Part of 505 Group

"I've worked with Chris Dowsett at Myriad since 2017, identifying qualifying R&D criteria while navigating BFI & HMRC submissions. Chris' knowledge of the entire VGTR process has exceeded my expectations and placed my business in a stronger position. I highly recommend Chris to all my business friends and connections."

Paul Adams

Full Fat Productions

"Chris at Myriad has greatly supported Teach Your Monster over the last five years, working with us to manage our annual VGTR claim for multiple games. His process knowledge is quite remarkable, given the detail and complexity involved. We have a high level of comfort knowing our claims are worked through with great attention to detail and with every area thoroughly scrutinised before submission. This has resulted in significant financial benefits to support our ongoing work developing educational kid's games. Chris is very approachable, always there when you need him, he knows his stuff inside out, and last but not least, he is very pleasant to work with!"

Alison Duddy

Teach Your Monster

"Chris and the team at Myriad did a fantastic job with our VGTR. Fast, supportive and knowledgeable. I would highly recommend."

Video Games Tax Relief is claimed as part of the Company Tax Return (CT600) filed with HMRC. To make a VGTR claim, you’ll need to be registered as a company and have the following documents:

You’ll need to calculate if your video game has made a profit or a loss and determine whether your VGTR claim should be surrendered as a loss for a cash repayment or used to reduce your tax bill.

HMRC has a specific approach for calculating the taxable profit and loss of a Video Games Development Company (VGDC). There are restrictions on how losses can be used, which will vary depending on if the video game is finished and trade has ceased.

The Video Games Expenditure Credit (VGEC) provides a 34% expenditure credit rate for video games.

The expenditure credit will be treated as gross taxable income and appear as other income in the financial statements. You can claim from 1st January 2024, and as it runs in parallel with Video Games Tax Relief, the claimant has a choice of what incentive to apply for.

Myriad is your go-to partner for a successful video games tax relief or video game expenditure credit claim.

Our experienced team of application specialists, cost accountants, corporate tax experts, and VGTR consultants have a reputation for helping UK game development companies unlock maximum value from government funding programs.

Let us help you claim VGTR for your project today!

Get in touch

The Video Games Expenditure Credit (VGEC) provides a 34% expenditure credit rate for video games (with a 5% uplift for animation, visual effects costs, and children’s TV to a credit rate of 39%). The expenditure credit will be treated as gross taxable income and appear as other income in the financial statements. You can claim from 1 January 2024, and as it runs in parallel with Video Games Tax Relief, the claimant has a choice of what incentive to apply for.

New video games must claim under the new expenditure credits from 1 April 2025, and all video games must claim under the expenditure credits from 1 April 2027 when the current Video games tax relief ends.

You will still be required to report each game as a separate trade for tax reporting purposes, and an online Additional Information Form (AIF) will become compulsory for all claims made on or after 1 April 2024. In addition to standard company and tax agent details, you must provide your VAT registration number and PAYE reference number. You must give critical information about the production or projects. This includes start dates, phase dates, total expenditure, and core expenditure. You must also include a digital version of each game's British Film Institute (BFI) certificate.

If you want to claim Video Games Tax Relief, your video game must be certified as British. You must pass the British Film Institute (BFI) cultural test to receive this certification.

To pass the BFI cultural test, complete an online application form for each video game for which you want to claim VGTR. The BFI will assess your application and award points based on the cultural content of the game, its cultural contribution, its cultural hubs, and its cultural practitioners. Each video game must score at least 16 out of 31 points to pass the test.

Myriad employs BFI application specialists who can help you pass this test. Contact us for advice.

The cultural test for video games is set out in The Cultural Test (Video Games) Regulation 2014, but for more information, read this.

In addition to completing an application form for each game, a Statutory Declaration to certify that the truth of the particulars in the application is also required.

The Statutory Declaration can be made before a practising solicitor, a general notary, a Justice of the Peace, or any other officer authorised by law to administer a statutory declaration under the Statutory Declaration Act 1835.

An accountant's report is required if an application for a final certificate relies upon points in Section C and/or Section D of the cultural test. The Accountant Report must be prepared by a person eligible for appointment as a company auditor under Section 1212 of the Companies Act 2006.

The BFI will generally issue a certificate within 28 days of receiving a fully completed application.

Delays may occur if application forms are not correctly completed or need further information. If you need the certificate by a specific date, make sure you apply in good time and specify your deadline date on the application.

A Letter of Comfort: If you’re not yet ready to complete a cultural test application, you can submit a draft application and receive a Letter of Comfort from the BFI. This letter will state that the video game(s) should pass the cultural test. A Letter of Comfort can’t be used to submit a VGTR claim to HMRC, but it is reassuring to have and can help you secure financing.

An Interim Certificate: You can apply for an Interim Certificate if your video game is still in production. An Interim Certificate will be issued once the BFI and the Department of Culture, Media and Sport (DCMS) are satisfied that your video game will pass the cultural test based on the proposals set out in your application.

A Final Certificate: A final certificate proving your game is British will only be issued after your video game is finished and ready for public consumption. Therefore, applications for a final certificate should not be submitted before the video game has been completed.

The Accountant's Report is required when an application claims points in Section C and/or Section D.

The Accountant's report aims to verify the total and UK expenditure of the work in Section C and the nationality or residence of all persons in Section D.

The Accountant's Report must be prepared by a person eligible for appointment as a company auditor under section 1212 of the Companies Act 2006.

An Accountants Report can cost between £500 and £2,000 per application, depending on the video game costs and the number of applications you submit.

The BFI cultural test regulations require you to make a statutory declaration which states that the information you’ve given in your application is accurate.

A statutory declaration is required for both the Interim and Final certifications.

The statutory declaration must be made before a practising solicitor, general notary, Justice of the Peace or an officer authorised by law to administer a statutory declaration under the Statutory Declaration Act 1835.

You can apply for both Video Games Tax Relief and R&D Tax Credits. However, you may only claim a given project cost against one of these schemes, not both.

In some instances, you can maximise your overall tax relief by applying to both schemes and claiming specific costs against each scheme on a project-by-project basis.

Myriad Associates can help you with this. To maximise your tax relief, we’ll study your projects, assess your costs and establish which project costs to claim under which scheme. Contact us for advice.

Non-core video game expenditure relates to initial design stage activities or commercial exploitation of the video game.

For example, the initial concept artwork used as part of the process of establishing commercial viability is not a core expenditure and is not eligible for VGTR. Advertising a video game isn’t classed as a development expenditure and is not, therefore, a core expenditure.

Ineligible expenditures include entertaining, publicity, promotion, audit fees, interest, completion bonds and other forms of insurance.

The amount of Video Games Tax Relief (VGTR) to which a Video Games Development Company (VGDC) is determined by the amount of core expenditure, which is also European Economic Area (EEA) expenditure.

Where a video game is partly produced in the EEA and partly outside of the EEA, it will follow that some goods and services may be non-EEA. In such cases, it will be necessary to apportion the relevant core expenditure between EEA and non-EEA expenditure.

This applies to goods and services provided throughout core expenditure stages. It applies to expenditure incurred during pre-development, production and post-development.

The apportionment method is not fixed and can be determined on a case-by-case basis. The key criterion is that it must be done fairly and reasonably.

There will often be more than one ‘fair and reasonable’ basis. The requirement is not that the apportionment must be made using the fairest and most reasonable basis but simply that it must be made on a fair and reasonable basis.

Step 1 of #

Is your business registered for Corporation Tax in the UK or are you a partnership with corporate owners?

Have you developed new or improved existing products, processes or services in the last 2 accounting periods?

Does your business have fewer than 500 staff, and either: A turnover of no more than €100 million; or Gross assets of no more than €86 million?

Sorry, you must be a UK limited company or be a Partnership with corporate owners to be eligible for R&D tax credits.

In order to qualify for R&D tax credits you must be seeking to advance science or technology within your industry. As you’ve not developed any new or improved any existing innovative tools, products or services, and not re-developed any existing products, processes or services in the last 2 years. It is unlikely you have any qualifying activity. If you’re unsure, email or call us and we’ll help clarify.

In order to claim R&D tax credits, you need to either employ staff or spend money on contractors, consumable items and other items. If you’re unsure, email or call us and we’ll help clarify.

Thanks for that!

Congrats!! Based on your previous answers, you will qualify for the SME scheme. If you’d like some help maximising and securing your claim, please email or call us.

Congrats!! Based on your previous answers, you will qualify for the RDEC scheme. If you’d like some help maximising and securing your claim, please email or call us.

Speak to an expert Back