Children's Television Tax Relief is a government funding incentive to support UK TV companies producing children's programmes that meet the BFI cultural test. The tax rebate is worth 20% of the pre-production, principal photography and post-production costs. HMRC manages the scheme, and claims are made as part of the Company Tax Submission.

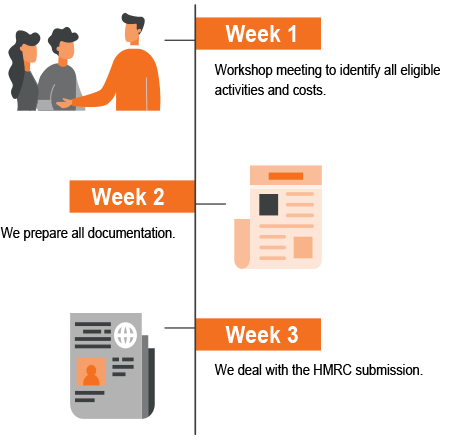

As your trusted partner, Myriad will ensure your Children's Television Tax Relief claim is accurate, compliant, and optimised.

Below are four simple sections to help you understand what Children’s Television Tax Relief (CTTR) is, how it works and whether you’re eligible.

Children’s Television Tax Relief is a creative industry tax relief incentive, funded by the UK government.

It offers Television Production Companies (TPCs) a tax rebate against the money spent on the pre-production, principal photography and post-production.

You can claim up to 20% of the core production costs of the piece with Children’s Television Tax Relief. TPCs can claim CTTR on the lower of:

If the company is profitable, the tax relief can be used to reduce a Corporation Tax bill. If loss-making, claimants can receive a cash payment from HMRC at a rate of 25%.

You need to meet specific criteria to be able to claim Children’s Television Tax Relief:

These criteria have several conditions, so contacting Myriad for our expert advice is best.

If you meet the above CTTR criteria then;

You can claim the expenditure for the pre-production, principal photography, and post-production, referred to as core expenditure.

This excludes development, distribution and other non-production activities.

Children’s Television Tax Relief is claimed as part of the Company Tax Return (CT600) that is filed with HMRC. To make an CTTR claim, you’ll need to be registered as a company and have the following documents:

HMRC has a specific approach for calculating the taxable profit and loss of a Television Production Company (TPC). There are restrictions on how losses can be used, which will vary depending on if the programme is finished and trade has ceased.

Companies in film, high-end TV programmes, children’s TV programmes and animation can claim Audio-Visual Expenditure Credit (AVEC) on expenditure incurred from 1 January 2024. You can claim the following expenditure credit rates:

Under the Children’s Television Tax Relief definition, a co-production is a programme produced under the terms of an international co-production agreement between two or more countries or authorities.

In the UK, such programmes are made under:

The advantage of a programme being made as an official co-production is that each producer can access the support within their respective countries, including tax relief where available.

To benefit from Children’s Television Tax Relief, there must also be;

If you want to claim Children's Television Tax Relief, your Children's television programme must be certified as British. You must pass the British Film Institute (BFI) cultural test to receive this certification.

To pass the BFI cultural test, complete an online application form for each high-end television programme for which you want to claim CTTR. If the programme is intended as a series, you can make one application to cover all episodes within the series. The BFI will assess your application and award points based on the cultural content of the programme, its cultural contribution, its cultural hubs, and its cultural practitioners. Each high-end television programme must score 18 out of 35 points to pass the test.

Myriad Associates employs BFI application specialists who can help you pass this test. Contact us for advice.

The cultural test for Children's television programmes is set out in The Cultural Test (Television Programmes), but for more information, feel free to contact us.

In addition to completing an application form for each high-end television programme, a Statutory Declaration to certify the truth of the particulars in the application is also required.

The Statutory Declaration can be made before a practising solicitor, a general notary, a Justice of the Peace, or any other officer authorised by law to administer a statutory declaration under the Statutory Declaration Act 1835.

An Accountant's report is required if an application for a final certificate relies upon points in Section C and/or Section D of the cultural test. The Accountant's Report must be prepared by a person eligible for appointment as a company auditor under Section 1212 of the Companies Act 2006.

The Accountant's Report is required when an application claims points in Section C and/or Section D.

The purpose of the Accountant's Report is to verify the total and UK expenditure of the work in Section C and the nationality or residence of all persons in Section D.

The Accountant's Report must be prepared by a person eligible for appointment as a company auditor under section 1212 of the Companies Act 2006.

An Accountant’s Report can cost between £500 and £2,000 per application, depending on the programme’s costs and the number of applications you submit.

The BFI cultural test regulations require you to make a statutory declaration which states that the information you’ve given in your application is accurate.

A statutory declaration is required for both the Interim and Final certifications.

The statutory declaration must be made either before a practising solicitor, general notary, Justice of the Peace or an officer authorised by law to administer a statutory declaration under the Statutory Declaration Act 1835.

Non-core expenditure relates to initial design stage activities or commercial exploitation of the children’s television programme.

For example, initial concept artwork used as part of the process of establishing commercial viability is not a core expenditure and is not eligible for CTTR. Marketing a children’s television programme isn’t classed as a development expenditure and, therefore, is not a core expenditure.

Ineligible expenditures include entertaining, publicity, promotion, audit fees, interest, completion bonds and other forms of insurance.

The amount of Children’s Television Tax Relief (CTTR) to which a Television Production Company (TPC) is entitled is determined by the amount of core expenditure related to activity undertaken in the UK.

Where a television programme is partly produced in the UK and partly outside of the UK, it will follow that some goods and services may be non-UK. In such cases, it will be necessary to apportion the relevant core expenditure between UK and non-UK expenditure. This applies to goods and services provided throughout core expenditure stages.

The apportionment method is not fixed and can be determined on a case-by-case basis. The key criterion is that it must be done on a fair and reasonable basis. There will often be more than one ‘fair and reasonable’ basis.

Contact the CTTR team today.

You can claim Children’s Television Tax Relief on your programme if:

For the purpose of tax relief, a television programme is defined as “any programme (with or without sounds) which is produced to be seen on television (including the internet) and consists of moving or still images or of legible text or of a combination of those things”.

There is a list of excluded programmes. If your programme falls into one of these categories, it does not qualify for Children’s Television Tax Relief:

Step 1 of #

Is your business registered for Corporation Tax in the UK or are you a partnership with corporate owners?

Have you developed new or improved existing products, processes or services in the last 2 accounting periods?

Does your business have fewer than 500 staff, and either: A turnover of no more than €100 million; or Gross assets of no more than €86 million?

Sorry, you must be a UK limited company or be a Partnership with corporate owners to be eligible for R&D tax credits.

In order to qualify for R&D tax credits you must be seeking to advance science or technology within your industry. As you’ve not developed any new or improved any existing innovative tools, products or services, and not re-developed any existing products, processes or services in the last 2 years. It is unlikely you have any qualifying activity. If you’re unsure, email or call us and we’ll help clarify.

In order to claim R&D tax credits, you need to either employ staff or spend money on contractors, consumable items and other items. If you’re unsure, email or call us and we’ll help clarify.

Thanks for that!

Congrats!! Based on your previous answers, you will qualify for the SME scheme. If you’d like some help maximising and securing your claim, please email or call us.

Congrats!! Based on your previous answers, you will qualify for the RDEC scheme. If you’d like some help maximising and securing your claim, please email or call us.

Speak to an expert Back